lvmh bcg matrix Practical Example: Applying the BCG Matrix. Apple is a well-known example of a company that effectively utilizes the BCG Matrix to manage its product portfolio and align it with the Apple business model. Star: iPhone. The . Chanel. Jersey Quilted 2.55 Reissue 226 Flap Black. $2,805. 76% Off Est. Retail $11,700. As low as $254 / month or interest-free with. Add To Bag. Free Shipping on Domestic .

0 · bcg matrix luxury

1 · bcg matrix logo

2 · bcg matrix

$10K+

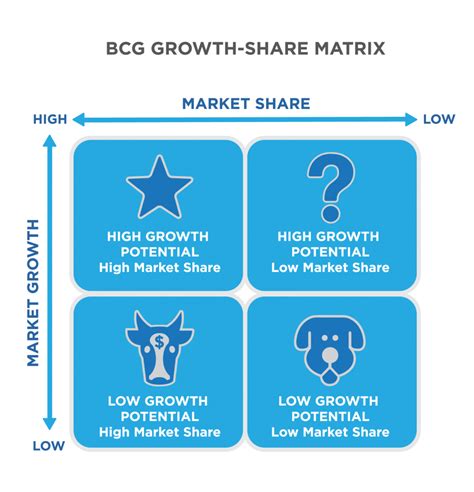

The BCG matrix is an effective tool that helps firms in analyzing their portfolio of products and make relevant decisions based on market share and growth rate. Based on this analysis, it is recommended that Louis Vitton .What is BCG / Growth Share Matrix? Introduction to BCG Matrix. At EMBA Pro , we highly recommend Louis Vuitton to use the BCG matrix / growth share matrix for portfolio . Now LVMH is switching to a more customer-oriented way of making business. The current divisional structure is efficient, but it is better for LVMH to go through the more matrix structure and centralize R&D, in the way . Practical Example: Applying the BCG Matrix. Apple is a well-known example of a company that effectively utilizes the BCG Matrix to manage its product portfolio and align it with the Apple business model. Star: iPhone. The .

Based on three distinctive yet intercorrelated perspectives of analysis, the study unpacks the bullish potentials of LVMH, its sufficiency in risk control and profit generation, and the. The essay intends to apply the BCG and Ansoff matrix to the Louis Vuitton company and present recommendations to help boost the company's productivity in the post-pandemic era.LVMH’s capital structure by holders, LVMH official reports. Mainly, the shareholders, apart from Berarnd Arnault and Bulgari Families or its controlling firms FINANCIER AGACHE and . This document provides an analysis of LVMH's competitive strategies. It examines LVMH's positioning using Porter's five forces model and generic strategies of differentiation and focus. LVMH's core competencies .

The document provides a BCG matrix analysis of strategic business units for Louis Vuitton. It identifies stars, cash cows, question marks, and dogs. For stars like financial services and top brands, it recommends investing through . Louis Vuitton, Gucci, Dior – a few powerhouse brands account for most of the sales and profits of giant luxury groups. There could be a reckoning for struggling lesser brands amid the fallout .BCG 매트릭스. BCG 매트릭스(BCG Matrix)는 미국의 보스턴 컨설팅 그룹(BCG)가 개발한 전략평가 기법이다. BCG는 기업이 사업에 대한 전략을 결정할 때 '시장점유율'(Market Share)과 '사업의 성장률'(Growth)을 고려한다고 가정한다. [1] BCG 매트릭스는 이 두 가지 요소를 기준으로 기업의 사업을 '스타(Star)사업 .Cash Cows. The supplier management service strategic business unit is a cash cow in the BCG matrix of LVMH New Generation New Image. This has been in operation for over decades and has earned LVMH New Generation New Image a significant amount in revenue.

1.1. Brief presentation of LVMH LVMH Moët Hennessy • Louis Vuitton, better known as LVMH, is a French multinational group, which owns more than 60 prestigious brands around the globe. The group has its headquarters in Paris, and it is chaired by Bernard Arnault, the tenth wealthiest man in .Recommendations Non- core luxury businesses can be divested (media business , art auctions) LVMH International Strategy LVMH International Strategy Shabnam Tahernia LVMH BCG Matrix LVMH is present in the media sector through Groupe . Unpacking the BCG Matrix. Originating from the Boston Consulting Group in the 1970s, the BCG matrix, or growth-share matrix, presents a method to evaluate the potential of a company’s diverse portfolio based on market growth and relative market share.

The essay intends to apply the BCG and Ansoff matrix to the Louis Vuitton company and present recommendations to help boost the company's productivity in the post-pandemic era. . The brand Louis Vuitton is managed by the corporation LVMH, which stands for Louis Vuitton Moet Hennessy. The mission statement of the company reflects five .

bcg matrix luxury

BCG of Louis Vuitton - Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online. The document provides a BCG matrix analysis of strategic business units for Louis Vuitton. It identifies stars, cash cows, question marks, and dogs. For stars like financial services and top brands, it recommends investing through . LVMH (Louis Vuitton Moët Hennessy) est un groupe dont l'existence est assez jeune. À l'origine se trouve le rapprochement en juin 1987 des entreprises Moët Hennessy (fabricant de champagne et de cognac) et de Louis Vuitton (mode et maroquinerie de luxe).Par la suite, c'est le business man Bernard Arnault qui devient actionnaire majoritaire - via sa holding .The BCG matrix was created by Bruce Henderson as a tool to assess the potential of any given company’s products and services, and then advise which ones a company should keep, sell, or invest more in.

The BCG Matrix is a strategic analysis tool used to examine the product portfolio of an organization by dividing its various business units or brands into four quadrants based on market growth rate and relative market share. This is a BCG Matrix analysis of LVMH-Moët Hennessy Louis Vuitton, the leading global luxury goods conglomerate: 1. The BCG Matrix was introduced almost 50 years ago, and is today considered one of the most iconic strategic planning techniques. Using management fashion theory as a theoretical lens, this paper . The Boston Consulting Group Matrix remains a powerful tool for strategic business analysis. It offers a simplified yet effective way to visualize and strategize business units or product lines based on market growth and relative market share. While it has limitations, its adaptability and straightforward approach make it a valuable model for .BOSTON CONSULTING GROUP 2 Frank Madlener, Director of IRCAM Emilie Metge Viargues, CEO of Christofle Thierry Oriez, Executive President of Henri Selmer Bruno Pavlovsky, President of Fashion at Chanel Gautier Pigasse, Head of Innovation and Blockchain at LVMH Guy Savoy, three-Michelin-star chef at the Monnaie de Paris Guillaume de Seynes, Executive Vice .

The world’s number one luxury group, LVMH, announced another record year for 2018.The French group posted sales revenue of 46.8 billion euros, up 9.8% and a result of 6.4 billion euros for the . Strong Parent company: LVMH (Moët Hennessy Louis Vuitton), a multinational luxury goods provider is the parent company of Louis Vuitton. It has dedicated 125000+ employees across the globe. LVMH is financially strong .McKinsey matrix analysis The position in the market for Fashion & leather goods and Watches & Jewelry is very important, LVMH is an important competitor and one of the leaders in these two business units Wines & Spritis and Perfume & .9. BCG Matrix of Tiffany & Co The LVMH Proposal The BCG Matrix is an important tool in deciding whether an organization should invest or divest in its strategic business units. The matrix involves placing the strategic business units of a business in one of four categories; question marks, stars, dogs and cash cows.

Louis Vuitton is a retail luxury fashion house and French Multinational Corporation. Louis Vuitton founded the fashion brand in 1854. Today, we’ll discuss the Ansoff matrix of Louis Vuitton; and its four growth matrix strategy analysis quadrants; market penetration, market development, product development, and diversification growth strategy of Ansoff matrix business example. 首先,提到波士顿矩阵,你会想到什么呢? 一个模型的产生,无非是我们根据实际情况的应运而生。所以,我们这里主要了解它的主要作用,应用于什么场景,也就是如何应用的问题,那么我们下面就来了解一下波士顿矩阵. LVMH is a French multinational corporation that was created in 1987 with the merger of two companies, Louis Vuitton and Moet Hennessy. . The BCG matrix would suggest that a large portion of this .

bcg matrix logo

LVMH -2016-2021 Debt to Asset Ratio. During this six-year period, there were two huge jumps that are 2018 to 2019 and 2019 to 2020. The first jump between 2018 to 2019 has a 6% increase from 54.3% . Exemple 3 : la matrice BCG de LVMH. Le groupe LVMH est plutôt récent même s’il affiche une insolente réussite. Né à la fin des années 80 de la fusion de Moët Hennessy et de Louis Vuitton, il est rapidement pris en main par Bernard Arnault. L’homme d’affaires va opérer de multiples rachats pour en faire un géant aux 70 marques . The BCG Matrix was created for the Boston Consulting Group by Bruce Henderson in 1968. In this article, we analyze products, bcg matrix and vrio framework for louis vuitton but the BCG Matrix can also be used to evaluate individual business units (called Strategic Business Units (SBUs)) or any other cash-generating assets, such as property. The Boston Matrix, BCG Matrix or Growth-share Matrix is a chart that was developed by the Boston Consulting Group in 1970. The BCG matrix model has long been used by companies to analyze their products and manage resources to identify which products to invest in and which to let go. In this article, we will review what is the BCG Matrix model and .

The Boston Consulting Group BCG Matrix is a simple corporate planning tool, to assess a company’s position in terms of its product range. The purpose of the BCG Matrix (or growth-share matrix) is to enable companies to ensure long-term revenues by balancing products requiring investment with products that should be managed for remaining profits.

bcg matrix

$19K+

lvmh bcg matrix|bcg matrix logo