can you write off a rolex as a business expense When you're looking at spending $10K on some bling, naturally you want to find a way to justify the purchase — and writing off your watch may seem like a great idea. 1967 Rolex Submariner Reference 5512 - HODINKEE Shop. Why This Watch Matters This desirable reference 5512 features a "meters first" dial showing the first signs of turning tropical. The overall soft patina makes this vintage Submariner a must.Rolex Submariner 5513 40MM Matte Black Meters First Dial Stainless Steel Oyster, Circa 1967 $ 15,995

0 · write off 10k rolex

1 · roman sharf watches tax write off

2 · how to write off a rolex

3 · can you write off rolex watches

4 · are luxury watches tax write off

Omega Speedmaster “Broad Arrow” (1957) The very first Omega Speedmaster was nicknamed the “Broad Arrow” due to its distinctive hands. It was also the first chronograph wristwatch in the world with its tachymeter scale on the bezel rather than printed on the dial — a feature designed with race car drivers in mind.

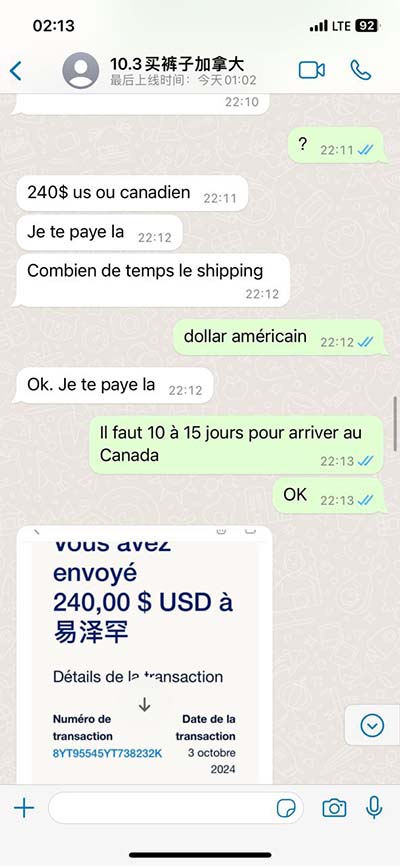

Figuring out where to draw the line between personal splurges and business necessities is key if you want to legitimately write off high-end purchases and avoid getting . Is a luxury watch a tax write off? In other words, can you deduct a luxury watch purchase as a business expense? Grey market watch dealer Roman Sharf of Luxury Bazaar made a video answering the question, but is he right or wrong? It seems somewhat reasonable. Can you write off a Rolex? Even if Rolex was a qualifying charitable organization, you wouldn't be able to deduct the purchase price of the watch. . In the case of Rolex, if .Could watches ever be considered a deductible business expense as say advertising for a financial service provider? Would wearing an expensive name brand watch such as Rolex not .

When you're looking at spending K on some bling, naturally you want to find a way to justify the purchase — and writing off your watch may seem like a great idea. The podcast began with a discussion on whether luxury watches like Rolexes can be classified as ordinary and necessary business expenses. Despite popular belief and .It makes you appear richer, it markets you and subsequently your business. The balls of steel method that could actually work would be to make a Rolex part of your company's uniform. .

One of the most common ways is through business expense deductions, but not every such expense is deductible. Here’s what to know about the expenses that you can — and can’t — properly claim on your federal .The reality, though, is that while the tax code may have some loopholes, you can't just write off anything and everything by claiming it's for "business." Here's what you need to. Is a luxury watch a tax write off? In other words, can you deduct a luxury watch purchase as a business expense? Grey market watch dealer Roman Sharf of Luxu.

write off 10k rolex

If you intend to sell it, or can feasibly say you intend to sell it, it's stock, and you can. You could also wear as much as you wanted and if anyone asks "I wear it to display it but it's clearly for sale" (you'd have to put up a sign somewhere saying something like "my watch is also for sale!"A Rolex is often considered the ultimate luxury item, but it comes at a hefty price. When you're looking at spending K on some bling, naturally you want to find a way to justify the purchase . Knowing which expenses you can deduct from your business income can be tricky. Get a take a closer look at business expense deductions, including travel, entertainment, meals, client gifts and vehicle expenses. . Personal expenses aren’t deductible by a business. You can, however, allocate expenses from items or services that serve both .

Even if Rolex was a qualifying charitable organization, you wouldn't be able to deduct the purchase price of the watch. . In the case of Rolex, if you buy a watch for ,000 at retail, the fair market value of that watch is considered ,000, and you receive no deduction.A Rolex, on the other hand, is obviously suitable for everyday wear outside of your job. Since it doesn’t meet the criteria, you can't claim a deduction for its purchase.

chanel 2009 cruise collection

If you have a car for business purposes, you can usually deduct anything considered a car expense. However, you have to have records that prove business usage, as well as keep track of your miles.According to the Internal Revenue Service (IRS), three primary categories of taxpayers can legally claim a business vehicle tax write-off on vehicles they personally own: business owners, self-employed individuals, and specific types of employees. Qualifying business owners and self-employed individuals include sole proprietors of Limited Liability Companies (LLCs), S . Is Rolex A Non Profit Organization00:17 - Can you write off a Rolex as a business expense?00:38 - How do I avoid tax on my Rolex?01:03 - Is a watch a tax ded. Yes, you can deduct expenses for a home office even if you use it part-time for business. The deduction is based on the percentage of your home used exclusively and regularly for business purposes , and you can choose between the simplified method (a standard deduction based on square footage) or the regular method (calculating actual expenses).

A Rolex is often considered the ultimate luxury item, but it comes at a hefty price. When you're looking at spending K on some bling, naturally you want to find a way to justify the purchase . If you have a car designated entirely for business use, you can deduct its full operating cost. If your personal vehicle is used in part for business purposes, however, you’ll need to divide your expenses to deduct only the business usage costs. There are two options for calculating the business use of your vehicle: Standard mileage rate Please contact us if you have any questions or concerns. We love to run through small business tax deductions with owners. And like a good parent, we try to find ways to say yes. Yes, you can go to Johnny’s house right after you clean your room. Yes, you can deduct that expense provided you document it this way.

13. Rent expense. If you rent a business location or equipment for your business, you can deduct the rental payments as a business expense. Keep in mind, rent paid on your home should not be deducted as a business expense, even if you have a home office. That rent can be deducted as a part of home office expenses. 14. Salaries and benefits

Medical costs quickly mount up. Keep the receipts if you, your spouse, or any dependents have incurred high medical costs; you may be able to deduct these expenses from your taxes. When filing your taxes, you can write off a variety of healthcare and medical expenses if you itemize your deductions rather than taking the standard deduction.This article delves into the intricate world of tax deductions and explores the question: Can you write off haircuts as a business expense? Understanding Business Expenses Business expenses encompass a wide array of costs .For instance, if you’re claiming mileage as a medical or charitable expense, you won’t do it the same way as a business expense. The forms you use and the amounts you can deduct per mile vary. If you are: A self-employed .If you rent an office space for your company or self-employed business, you may be eligible to deduct the rent as a business expense if you meet the specific conditions outlined in IRS Publication 535.. You may only write off rent on your business’s office space if:. You do not own the property or receive equity in the property

6. Business Start-up Expenses Have a brand-new business? All costs incurred during the first year of trading, during the process of setting up your business can be claimed. For instance, any equipment bought for the purpose of running your business, can be claimed as a tax-deductible business expense. 7. Large Capital Expenses There are many . The travel expenses you can write off. As a rule of thumb, all travel-related expenses on a business trip are tax-deductible. You can also claim meals while traveling, but be careful with entertainment expenses (like going out for drinks!). Here are some common travel-related write-offs you can take. 🛫 All transportation

Freelancers and independent contractors can sometimes deduct coffee as a business expense, but it depends on the context. Coffee is generally deductible if it's for a client meeting, staff meeting, office supply, travel, gift, promotional event, or staff party. However, personal coffee purchases, courtesy coffee at cafes, and home office coffee . Capital expenses: Business startup costs, business assets and improvements are not deductible.Instead, you can recover them through depreciation, amortization or depletion. Personal expenses: You .

A Rolex is often considered the ultimate luxury item, but it comes at a hefty price. When you're looking at spending K on some bling, naturally you want to find a way to justify the purchase .

Why? Because you can go to dinner in it without looking out of place. How to write off personal appearance expenses. It's tricky to treat any appearance-related cost as a deductible business expense. But here’s the good news: you can make a case for it. Let's take a closer look at how to write off these types of expenses. Haircuts and haircare

If you purchased a membership to entertain clients, then it can be deducted as a business expense. You can also deduct a club if it’s used to recruit clients. If you participate in a professional club, as long as it is not on the prohibited list, there are eligible deductions. Any expenses that have been reimbursed are no longer eligible for . Luckily, those laundry fees count as a legitimate business expense, and you can deduct them on your taxes. That's true even if you're washing clothes suitable for everyday use, even though they normally wouldn't qualify as a business expense. Think of it this way: traveling was necessary for your work. And you wouldn't have spent that extra .

roman sharf watches tax write off

coco chanel style

louis vuitton seriennummer check

This gold Speedmaster is also referred to as a “Tribute to Astronauts” watch. It was the first gold Speedmaster that Omega created, and it was offered to the .

can you write off a rolex as a business expense|are luxury watches tax write off